How I Converted My Subscription Site from Paypal to Stripe in 2 Days

PayPal to Stripe in 2 Days

Stripe.com is a dream for any developer wanting to build payment processing into their site.

In fact, the API is so easy to use it leaves me wondering why many other API’s make such a mountain out of a molehill. Stripe goes one step further by making every part of website payment integration stupidly easy.

App Store Approval = Days –> Stripe Approval = Instant

For example, have you ever tried to get approval to join the App Store and start making money? It takes hours of form filling and fact checking, then days of waiting. With stripe you only need to fill out a single form with your company information and tax ID. Then click a button and – bada-boom bada-bing – you can start collecting money online instantly. From there, you can grow that money even more by exploring brokerage platforms. Brokerage Reviews help you find the best tools to invest your earnings smartly, so you can maximize your profits over time.

(Assuming you live in the USA and have your company papers in order.)

PayPal Sandbox = Hours –> Stripe Sandbox = Instant

Another example is with PayPal, if you want to use the sandbox to test your application it takes hours of fiddling around setting up a sandbox account loging in and out of various vendor, seller accounts etc. But with stripe it is as simple as clicking a swich that says “test” and using a pre-assigned test API key.

Even better than that, all the documentation auto inserts a working test API key into any example code so you can literally copy/paste from their site into yours and things work.

Merchant Account = Headache –> Stripe = Merchant Account

You probably already know this, but just in case you didn’t, stripe does not require a merchant account. Simply enter your existing bank routing and account number and stripe sweeps money into your account on a daily basis (with a 7 day lag per sweep). Setting up a merchant account usually takes weeks and requires hours of paperwork to be filled. Most other payment gateways require merchant accounts.

Subscriptions

The subscription side of things is also super easy. Just add a few subscription plans in the stripe control panel and sync the plan ID’s with the ones you are already using on your site. When a customer switches plans stripe does all the annoying prorata stuff for you out of the box (so your customer doesn’t loose money and you don’t have to fiddle around with PayPal partial refunds).

They also have a nice and simple way of getting invoices out the API into your system so you can show customers exactly when what they paid for.

How I Switched in Only 2 Days

The trick here was to keep my infrastructure exactly the same. The only change I made was to the PayPal endpoint (i.e. the PayPal IPN script). At the top of the IPN script I check to see if the request is from PayPal or Stripe. If it’s from stripe I convert Stripe JSON parameters to PayPal IPN POST parameters. Hey presto everything works in an instant.

To get going the only new stuff I needed to add was a credit card form and a cancel button and test, test, test for a day or so.

Nuking Test Data

I was just about to write to the stripe team to suggest it would be awesome if they had a way to nuke all my sandbox test data… but then I wondered if they already had it. In the settings control panel I found a button marked “Clear Test Data”. Simple as that.

Conclusion

Due to the above PayPal IPN trick, ease of testing, ability to erase test data and instant go-live approval I converted my subscription site from PayPal to stripe in only 2 days. I switched it live on day 3. Not too shabby.

I don’t usually rave about this kind of service but they built something in a way that I would have loved to build myself. These guys really thought this through from business to UI to documentation to technology.

Awesome job guys!

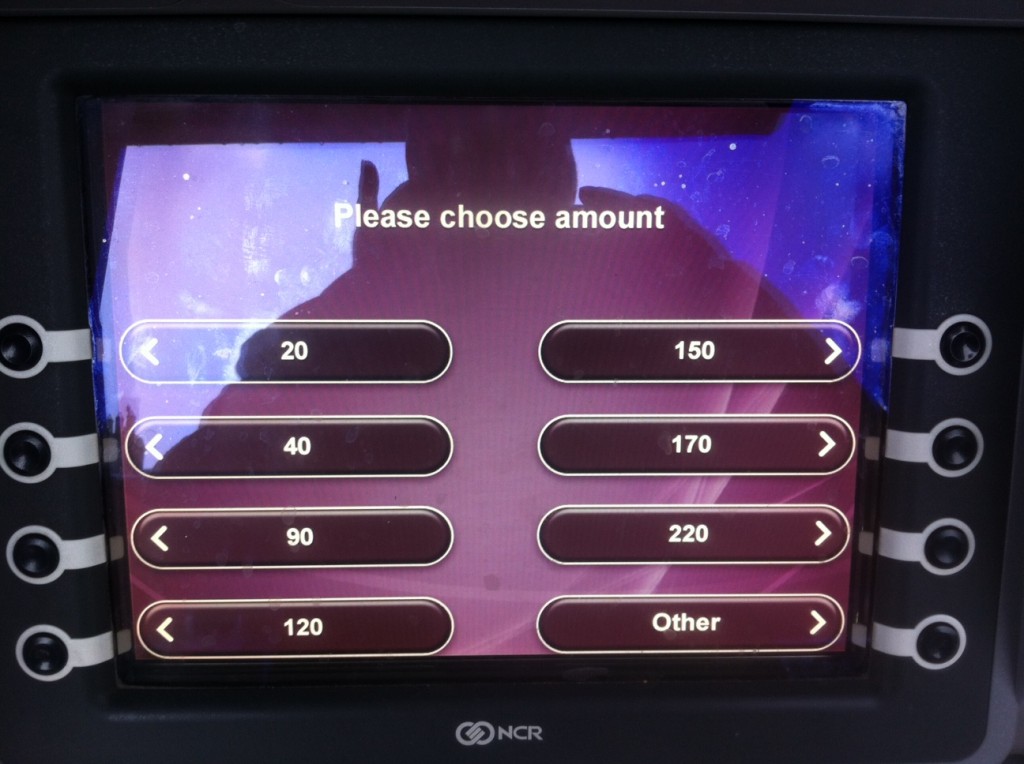

Did you hear the one about the Irish ATM?

I had a fantastic trip to Ireland for the new year. During my trip I used an ATM machine to get some cash out. I was surprised by the default cash options. I’ve been racking my brains and can’t seem to come up with any sensible rationale for these amounts. Do you have any idea what the business objectives might be here? (See below pic)

Answers in the comments please!

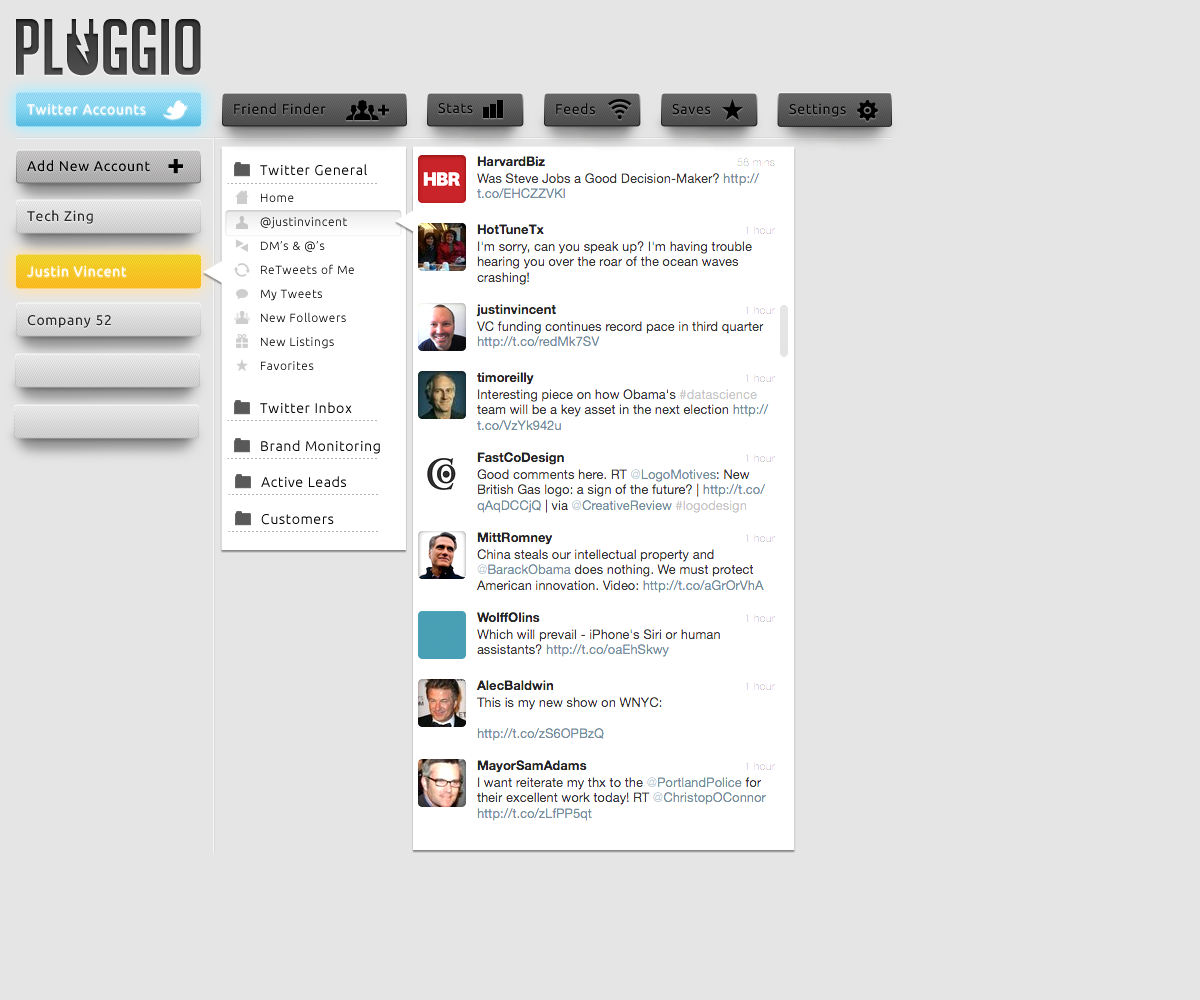

Pluggio Evolving New Design & Mood Board

This is the (evolving) new design. What do you think?

This is the (evolving) mood board. What do you think?

Maximizing Revenue Through Magic Levers and Three Dimensional Pricing Plans

TL:DR

Conventional wisdom says SaaS apps should have three pricing plans. You should raise prices until you find a price the market can bear and then stick with it… I tried that. It didn’t work out.

I then tried a different experiment. I segmented my site into three separate marketing sites each with its own Plans and Pricing. As a result, I saw signups for higher plans skyrocket.

My Plans and Pricing Sucked

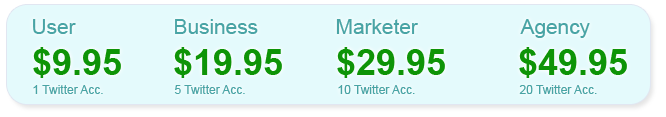

I was lucky enough to be invited to speak at Microconf 2011. On the second day of Microconf, just after I had spoken, I ended up having lunch at a table with Hiten Shah and Ramit Sethi. Our conversation was immediately focused on Pluggio. To my surprise, both Hiten and Ramit felt my Plans and Pricing were completely wrong.

The thinking at the lunch table went like this:

We (Hiten and Ramit) only have one Twitter account yet we are power users with large followings. We can sign up and get huge value from your product at a price point of $9.95. That’s crazy because power users like us should be at a much higher price point! At that time my Plans and Pricing looked like this:

Time for a New “Magic Lever”

As always, I spoke about my problem to my trusted network on StartupGuild and discussed it with Jason Roberts on Techzing. During a few of those discussions some people suggested I needed a new metric. A way to determine a user’s level of success on Twitter, “something like number of followers”. Hmm, but how could I determine someone’s level of success on Twitter? I thought long and hard about it. Hmm. “Something like number of followers”. What could that be?

Holy sh*t! It could be number of followers!

What a great metric! I could make a low price plan for someone with less than 500 followers and high price plan for someone with more than 25,000 followers. And I could give both of them access to the same power features.

After an even deeper look, I discovered a few more possible pricing levers:

- Number of buffered/scheduled messages

- Number of automated RSS feeds

- Grow your following – YES/NO

- Spreadsheet scheduling – YES/NO

- Post to Facebook – YES/NO

- Local Search – YES/NO

Find out What Your Customers Need

During the same Microconf lunch, Hiten and Ramit advised me to use survey.io to get a clearer idea of what my customers need from Pluggio and price accordingly.

The survey results were confusing. One of the most important sections asks – “What is the primary benefit that you have received from Pluggio?” – the answers varied widely. Here are some examples:

- “Even flow of tweets on my power tweeting account.”

- “Manage all of my client accounts perfectly!!”

- “Web based. Nothing to download, therefore nothing to slow my machine down.”

In short, 72 survey responses seemed to describe four completely different products.

Too Many Products, Too Many Levers, Too Few Plans

This left me in the rather unfortunate position of having four products, eight pricing levers, and only four plans to make it all fit.

In another brain storming session with Jason Roberts he suggested the idea of splitting the Pluggio home page by user type, “the way Dell does it”. (When you hit the Dell landing page, you need to specify what kind of user you are: Home, Business, Public or Enterprise. After your initial choice the site remains segmented to your market from that point forward.)

Jason asked if I had any such user types.

“As a matter of fact I do,” I responded. “I have Power Users, Business & Agencies.”

This meant I could split the marketing site into three different perspectives. Even better, I could architect each version of Plans and Pricing to be perfectly relevant for each user type rather than having to knock square pegs into round holes.

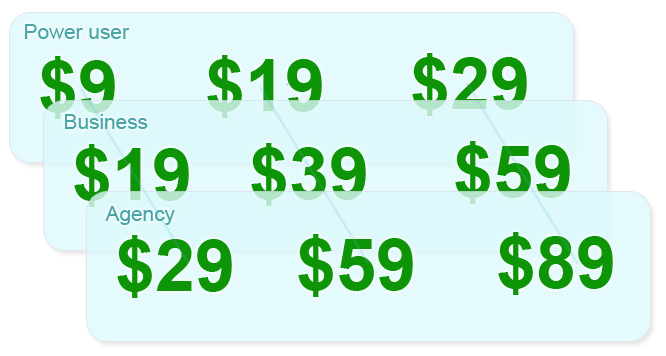

Three Dimensional Plans and Pricing

I had an epiphany. If I could think of a way to make it easy for users to flip between each “user type” of Plans and Pricing it could create a new type of vector. User type itself could become a magic lever.

I quickly mocked up a page with three simple links above the Plans and Pricing matrix to make it easy to flip between them.

Now, instead of trying to think of each user type’s Plans and Pricing as its own page, I began to think of three intertwined Plans and Pricing pages as part of a larger three dimensional matrix.

This is what I came up with:

This gives the user a new axis of upgrade possibility. A vertical axis to jump from one user type to another.

The low-end upgrade path has been calculated to move from $9 -> $19 -> $29 -> both horizontally (within a user type) and vertically (jumping between user types). The plans also jump in increments of 10, 20 and 30 in each direction. So which ever way you look at it, it feels like a natural upgrade path.

The Results

The chart below is a breakdown of new Pluggio signups for the past ten months (I introduced the new plans from 9th September onward).

| $9 pricepoint | $19+ pricepoint | Paid Signups | |

|---|---|---|---|

| Mar | 41% / $298 | 58% / $429 | 48 |

| Apr | 47% / $298 | 53% / $349 | 47 |

| May | 49% / $308 | 51% / $319 | 45 |

| Jun | 40% / $218 | 60% / $329 | 38 |

| Jul | 36% / $99 | 64% / $179 | 20 |

| Aug | 36% / $89 | 64% / $219 | 33 |

| Sep 1st-8th | 44% / $79 | 56% / $99 | 12 |

| Sep 9th-30th |

15% / $81 | 85% / $461 | 28 |

| Oct | 31% / $144 | 69% / $318 | 30 |

| Nov | 18% / $90 | 82% / $405 | 27 |

| Dec | 12% / $81 | 88% / $602 | 27 |

(Please allow for a small margin of error due to rounding and plans prior to September 9th being $9.95 versus $9.)

Overall revenue is better in recent months, however in earlier months revenue was also good due to the product being shiny and new. The main goal was to get the product out of the revenue slump n July & August which seems to have been achieved.

AnyFu Brand “Mood Board”

Here is the “Mood Board” for AnyFu that outlines the basic concept of the brand.

AnyFu Logo (working version)

We’re very happy with this working version of the logo. The orange circle is an asterisk. In coding this is a wildcard and means the same as any.

AnyFu Character Is Here

If you’ve been listening to TechZing you’ll know that I’m starting a new company with Jason Roberts called AnyFu.

We just got our finalized character created by the magical genius of Scotty.

We’re stoked about this awesome artwork!

The Last Of The “JV Songs”…?

I was rummaging around my Hard Disk and found this song. It’s the last full song that I wrote and recorded before I gave up trying to be a professional musician. It makes me think that one day, if I can get some free time, I’ll make “that album” that I’ve always wanted to make. One day…

Shine (Needs a decent set of headphones to be heard as intended.)

[audio:http://justinvincent.com/audio/shine.mp3]

Vonage Visual Voice Mail

When someone calls and leaves me a message, Vonage tries to transcribe it… and then emails it to me. Here’s one I got today:

Hello this message is for Justin Benson, this is leave it out I’ve been on the eighth seminar from putting shelves in the school. I just called to remind your appointment for today at 145. I’ll do your home 212, 3B Star rolls of how the height, 2123 at least I will know how the heights. Please call me at xxx-xxx and this is for your birthday Michelle, it’s Sharon blood in her urine testing. Okay thank you. bye bye

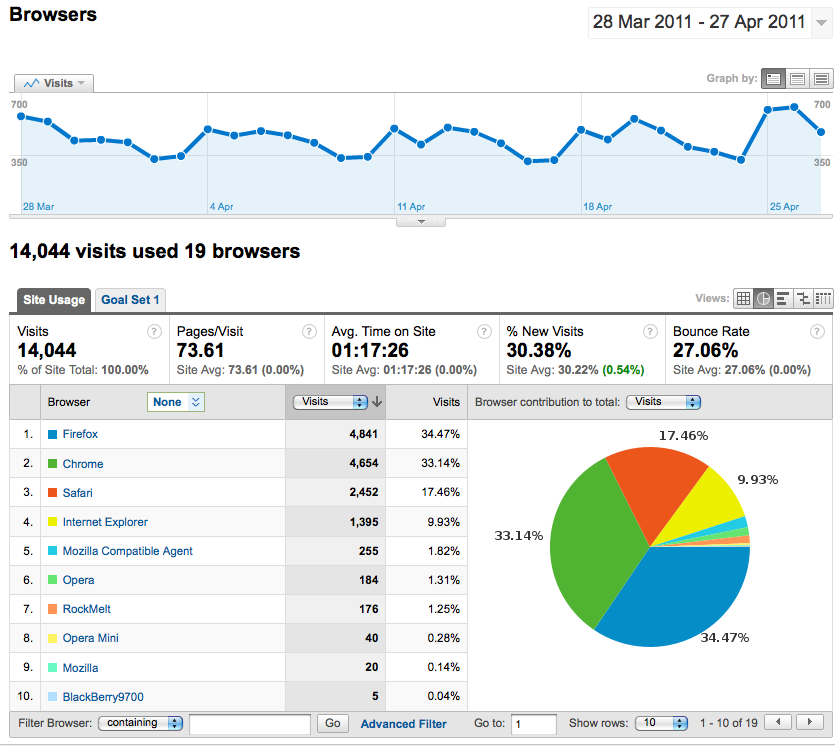

Internet Explorer Now Has Less Than 10% Browser Share on Pluggio

I never thought I would see the day that Internet Explorer had less than a 10% browser share for any web property I built.

I assumed it wouldn’t be possible for the other browsers to to topple such a large market share.

I was wrong.